As one of the fastest-growing areas in technology, AI models are seeing explosive adoption across industries.

Thousands of companies and developers are building, using, and exploring AI models, driving rapid growth in both number of models and market value.

With that in mind, here’s a breakdown of what we’ll cover:

AI Models Stats 2025 (Top Picks)

Here are five key insights into the AI model landscape:

- There are currently approximately 1,985,043 public AI models.

- 78% of companies worldwide report using AI in some capacity.

- Out of 333 million companies, over 300 million are using or exploring AI.

- The global AI market is valued at around $400 billion and projected to reach $1.81 trillion by 2030.

- Top AI models include GPT-5 (OpenAI), Gemini 2.5 Flash-Lite (Google), Aya Expanse (Cohere), Gemma 3 4B & Mistral 3B, and Llama 4 Scout (Meta).

For further details and more statistics, keep reading.

How Many AI Models Exist?

As of 2025, there are approximately 1,985,043 public AI models worldwide.

The most downloaded model is Falconsai/nsfw_image_detection, highlighting the popularity of specialized AI applications.

AI models are being applied across industries, from image classification to content generation, and their adoption is accelerating year over year.

Source:

Categories of AI Models

AI models can be grouped into several major categories based on functionality and industry impact:

- Large Language Models (LLMs) – GPT, Claude, Gemini, LLaMA, Mistral. These models are transforming content creation, SEO, and productivity.

- Image Generation Models – DALL·E, MidJourney, Stable Diffusion. These impact creatives, advertising, and branding workflows.

- Audio & Speech Models – Whisper, ElevenLabs, AudioLM. Key for podcasts, voice search, and accessibility.

- Video Models – Runway Gen, Pika Labs, Sora. Used in content marketing, video SEO, and creative production.

- Specialized Models – AlphaFold, robotics, healthcare, finance. Enable industry-specific adoption opportunities.

AI Model Market Trends

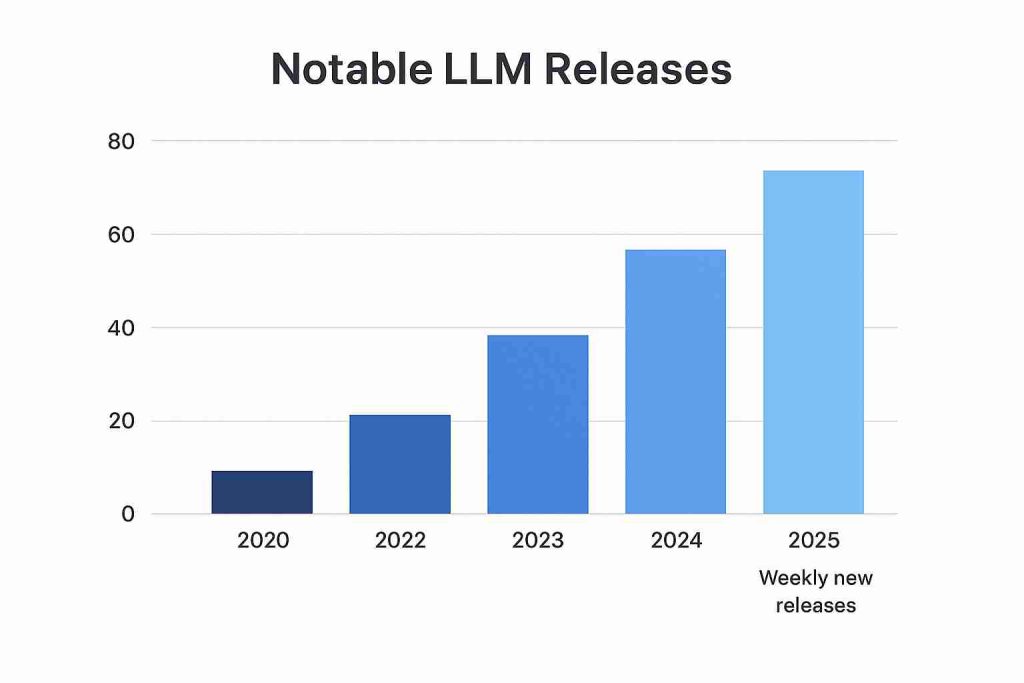

In 2020, just 11 large-scale AI models were released, with months or years between launches.

By 2022, the pace began to accelerate as more companies and labs entered the race.

In 2023, model releases more than doubled vs. 2022, driven by ChatGPT and GPT-4, along with a surge in open-source models.

In 2024, the count reached 81 notable models, a 7x increase since 2020. Nearly 90% came from industry, showing a shift away from academia.

By 2025, new models will be announced almost weekly as Google, OpenAI, Meta, Anthropic, and others compete head-to-head. Performance gaps are narrowing, making AI a mainstream business tool rather than a niche experiment.

Model releases have grown exponentially in recent years:

Year |

Notable LLM Releases |

|---|---|

2020 |

11 |

2022 |

30+ |

2023 |

60+ |

2024 |

81 |

2025 |

Weekly new releases |

Global AI Adoption

Over the last decade, AI adoption in businesses has grown rapidly.

In 2017, only 20% of companies reported using AI in at least one business function. By 2018, adoption had more than doubled to 47%.

Adoption continued steadily, reaching 58% in 2019, before stabilizing around 50–56% from 2020 to 2022. Since 2022, adoption has accelerated again, climbing to 72% in 2024 and 78% in 2025.

Generative AI adoption has surged. As of 2025, 71% of companies use generative AI in at least one function, and 92% plan to increase AI investment over the next three years.

Globally, there are 333 million companies, meaning over 300 million businesses are using or exploring AI.

AI adoption also varies by company size:

Company Size |

Current Usage |

Projected Usage |

Growth |

|---|---|---|---|

1–4 employees |

5.5% |

7% |

27% |

100–249 employees |

4.8% |

7.8% |

62.5% |

250+ employees |

7.2% |

11% |

52.8% |

Smaller firms are catching up, while larger enterprises remain early adopters, driving real-world AI applications.

AI startup activity reflects this trend. In Q1 2022, 688 new AI startups were launched. By Q1 2023, the number dropped to 269 (a 69% decline), while bootstrapped AI products grew 300%. Most AI startups remain small, with 83% having fewer than 10 employees.

AI adoption over time:

Year |

Percentage of Companies Using AI |

Increase Over Previous Year |

Increase Over Previous Year (%) |

|---|---|---|---|

2017 |

20% |

– |

– |

2018 |

47% |

↑ 27% |

↑ 135% |

2019 |

58% |

↑ 11% |

↑ 23% |

2020 |

50% |

↓ 8% |

↓ 13.8% |

2021 |

56% |

↑ 6% |

↑ 12% |

2022 |

50% |

↓ 6% |

↓ 10.7% |

2023 |

55% |

↑ 5% |

↑ 10% |

2024 |

72% |

↑ 17% |

↑ 30.9% |

2025 |

78% |

↑ 6% |

↑ 8.3% |

Source: McKinsey, IBM, Forbes, Sortlist, McKinsey, McKinsey

AI Model Leaders

The top LLMs are evaluated on intelligence, speed, latency, price, and context window.

Intelligence (Reasoning & Knowledge)

Rank |

Model |

Benchmark Score |

|---|---|---|

🏆 1 |

GPT-5 (OpenAI) |

68–69 |

🥈 2 |

Grok 4 (xAI) |

– |

🥈 3 |

o3-pro (OpenAI) |

– |

🥉 |

Claude 4.1 Opus |

– |

🥉 |

DeepSeek V3.1 |

– |

🥉 |

Gemini 2.5 Pro |

– |

Output Speed (Tokens/sec)

Model |

Tokens/sec |

|---|---|

Gemini 2.5 Flash-Lite |

385 |

Nova Micro |

318 |

gpt-oss-20B |

262 |

Latency (Time to First Token)

Model |

Latency |

|---|---|

Aya Expanse 8B |

0.15s |

Aya Expanse 32B |

0.18s |

Command-R / Command-A |

~0.20s |

Price ($ per Million Tokens)

Model |

Price |

|---|---|

Gemma 3 4B & 3n E4B |

$0.03 |

Mistral 3B |

$0.04 |

Llama 3.2 3B |

$0.09 |

Context Window (Tokens)

Model |

Tokens |

|---|---|

Llama 4 Scout |

10M |

MiniMax-Text-01 |

4M |

Gemini 2.0 Pro / 1.5 Pro |

1–2M |

Top Performing AI Models

The most intelligent model is GPT-5 from OpenAI. It leads reasoning and knowledge benchmarks.

The fastest generator is Google’s Gemini 2.5 Flash-Lite, producing 385 tokens per second, ideal for real-time applications.

Cohere’s Aya Expanse models deliver the lowest latency, making them perfect for responsive chatbots and live interactions.

On cost, Gemma 3 4B and Mistral 3B are the most affordable, priced at $0.03–$0.04 per million tokens.

Meta’s Llama 4 Scout supports the largest context window at 10 million tokens, enabling book-length memory and long-document workflows.

What It Means for Businesses

High-intelligence models like GPT-5 and Claude Opus are best for enterprises in research, legal, healthcare, and finance.

Startups and independent developers benefit from budget-friendly models such as Gemma and Mistral for scaling applications without heavy costs.

Low-latency models like Aya Expanse and Gemini Flash are ideal for real-time applications, including live voice and chatbots.Models with large context windows, such as Llama 4 Scout and Gemini Pro, support content-heavy workflows, long-form documents, SEO content, and automated reporting.

Source: ArtificialAnalysis

The Future of AI Models

The global AI market is currently valued at around $400 billion, driven by applications from content creation to self-driving cars.

It is expected to grow nearly 5x, reaching $1.81 trillion by 2030, with a CAGR of 35.9%.

The AI software market alone generates over $100 billion annually:

Year |

AI Software Revenue |

|---|---|

2018 |

$10.1B |

2019* |

$14.69B |

2020* |

$22.59B |

2021* |

$34.87B |

2022* |

$51.27B |

2023* |

$70.94B |

2024* |

$94.41B |

2025* |

$126B |

*Projected figures

AI is moving from a research niche to a mainstream industry, with adoption across enterprises, startups, and individual developers fueling unprecedented growth over the next decade.

Conclusion

The number of AI models is growing at an unprecedented pace, with nearly 2 million public models in 2025 alone.

As companies of all sizes continue to adopt AI, from high-intelligence LLMs for enterprises to cost-effective models for startups, the AI market is only set to expand further.

With a global market valued at $400 billion and projected to reach $1.81 trillion by 2030, AI tools are becoming essential for content creation, automation, customer engagement, healthcare, finance, and more.

For more related insights, check out: